Municipal Bond Pricing App

App Features

Key Muni Bond Metrics

Term, Yield to Maturity, Price, Price to Date, PV01

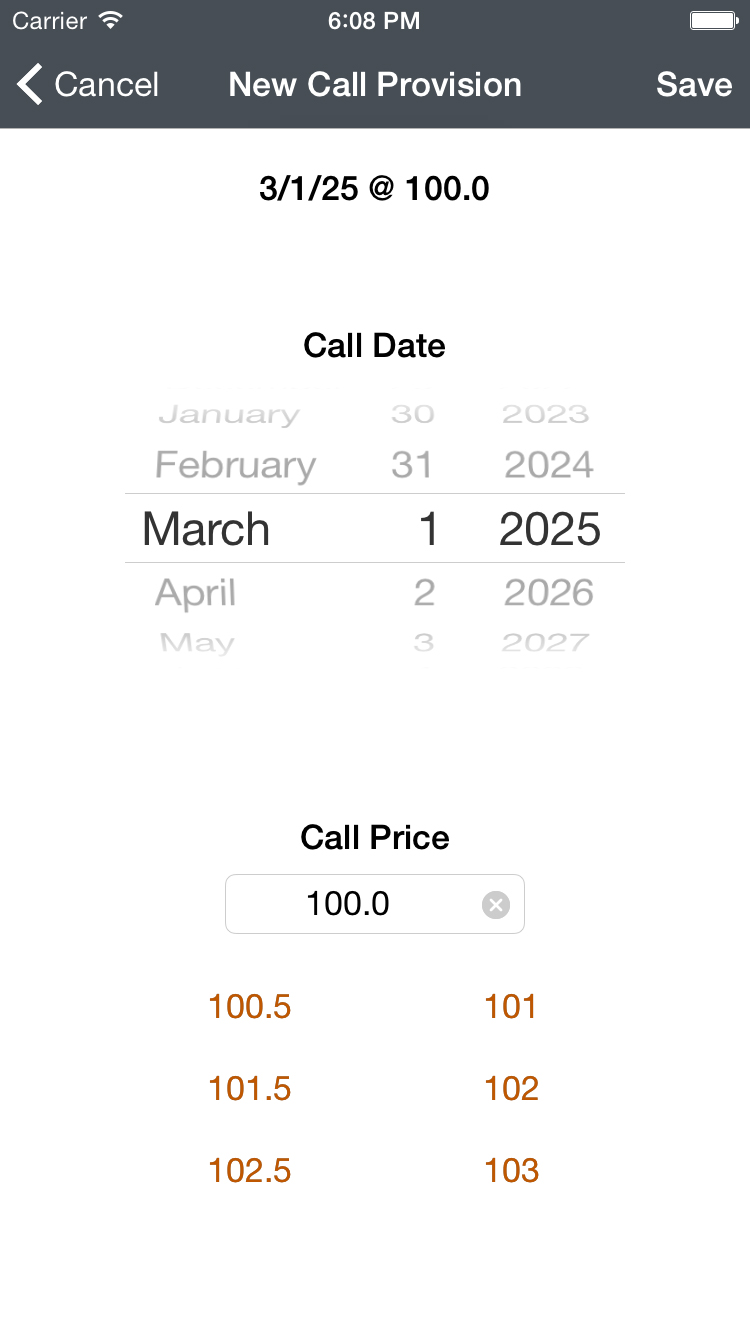

Multiple Call Provisions

Add as many call dates as needed - Price will adjust accordingly

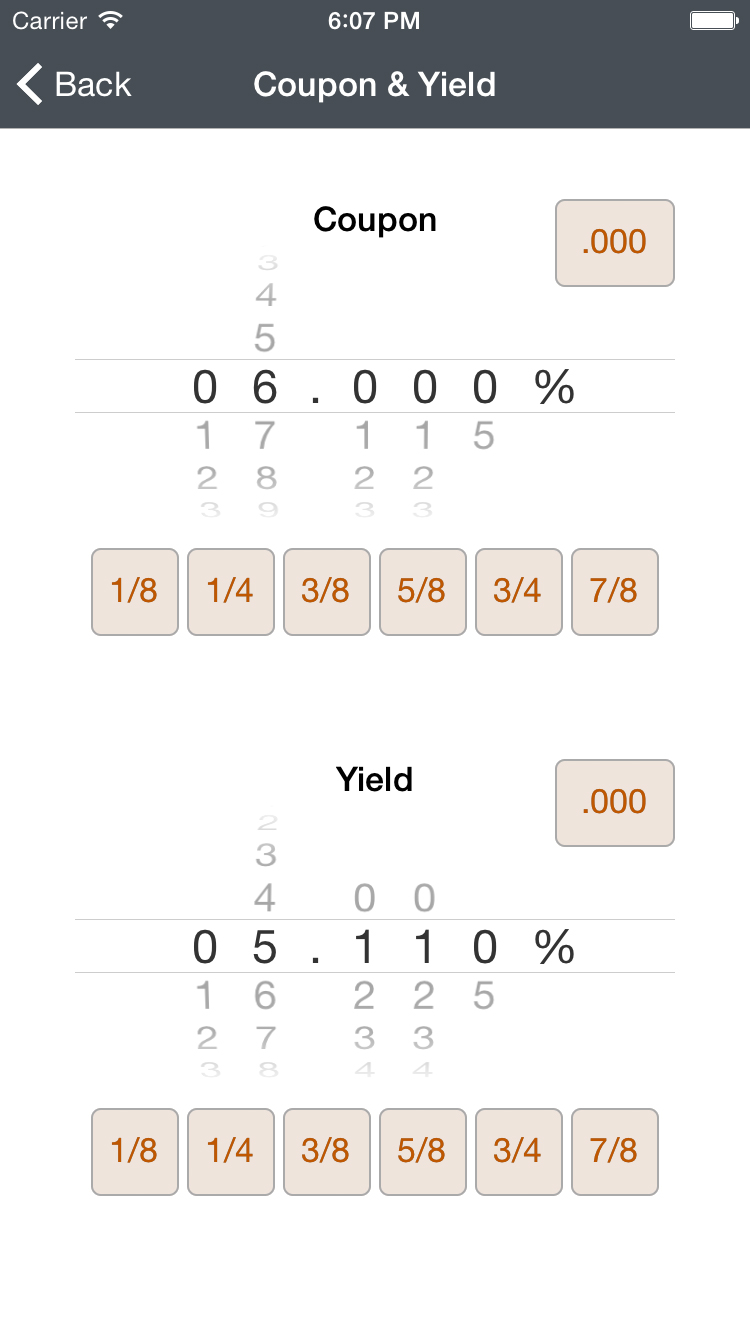

Quick Set Buttons

Allows for quick entry of often-used or hard-to-enter numbers or dates

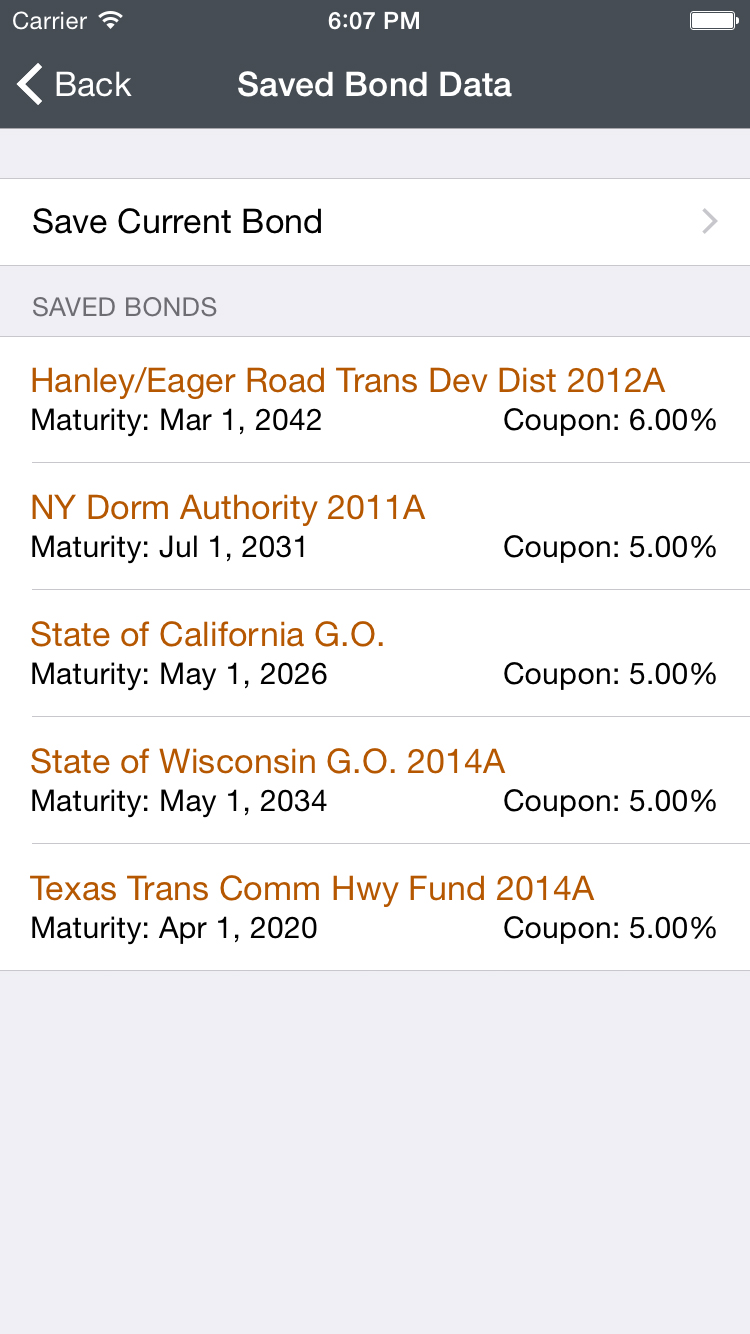

Save and Retrieve

Retrieve saved bonds at a later time

Intuitive Entry Methods

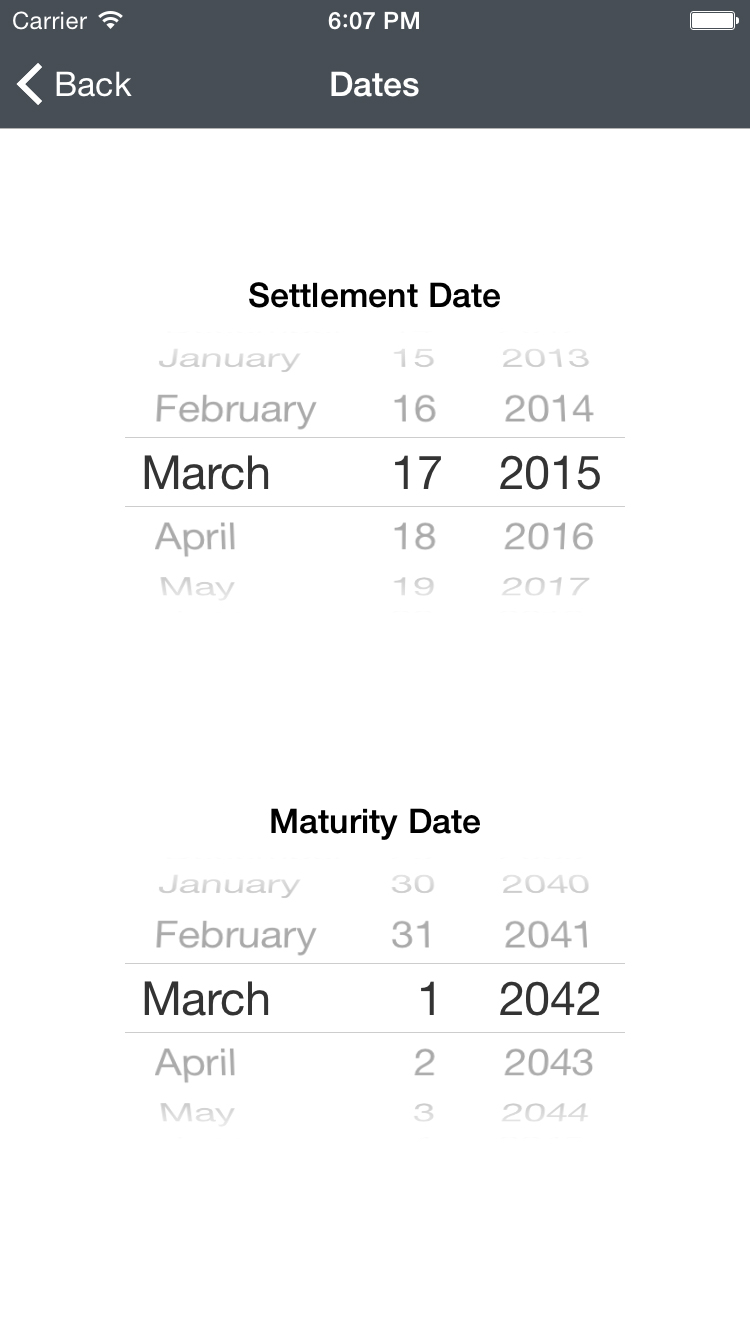

Uses familiar iOS input methods

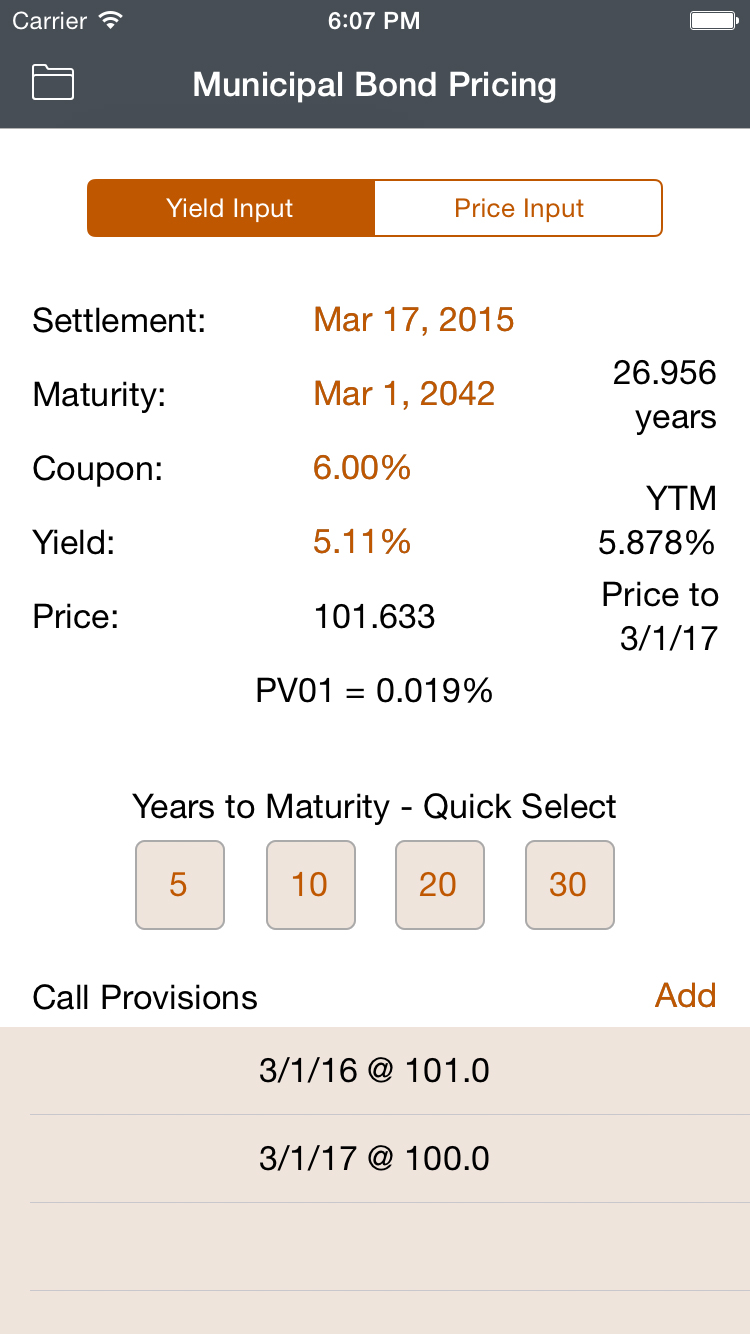

This app is a municipal bond analytics calculator. You enter the settlement date, maturity date, coupon rate, and multiple call dates (if applicable). Then, you can either enter the yield to determine the bond price, or you can enter the bond price to determine the yield. Other information that the app calculates includes the term of the bond, the yield to maturity, the date to which the bond is priced, and the present value of a 1 basis point movement in yield.

• USER FRIENDLY INTERFACE – efficient entry methods (mostly touch instead of text entry)

• QUICK SELECT BUTTONS – quick select buttons are included for speed of entry

• YIELD OR PRICE INPUT – can easily switch between yield input to calculate price or price input to calculate yield

• MULTIPLE CALL DATES – allows for multiple call dates, and the bond will be priced to the date with the lowest price

• SAVE AND RETRIEVE – ability to save and retrieve bonds later with your own custom titles

• MSRB CALCULATIONS – price and yield calculations comply with the Municipal Securities Rulemaking Board (MSRB) Rule G-33*

*The Municipal Bond Pricing app uses the standard 30/360 day count convention and assumes semi-annual interest payments.